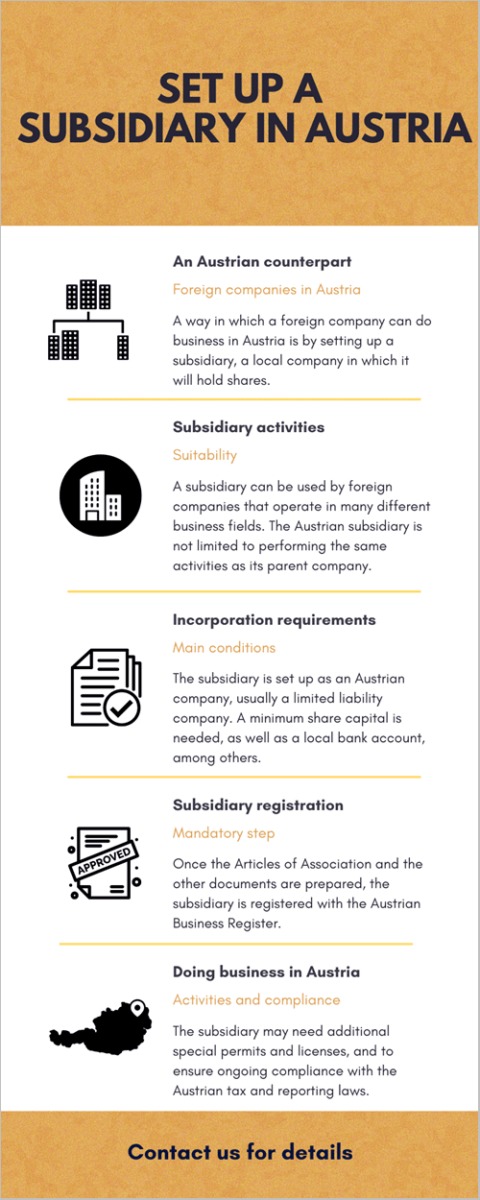

Opening a subsidiary in Austria can be a strategic move for foreign companies seeking to explore the business opportunities within the Austrian market. An Austrian subsidiary company falls under the scope of the Company Law and is subject to an easy incorporation procedure. Our company formation agents in Austria can explain the requirements related to opening a subsidiary. The process for subsidiary creation in 2024 remains essentially unchanged in Austria, continuing to be based on the same mandatory steps required for the creation of a locally registered legal entity.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Foreign country |

|

Best used for |

– trading, – IT, – commerce, – pharmaceutical etc. |

|

Minimum share capital |

– 10,000 EUR for private companies, – 70,000 EUR for public companies |

| Time frame for the incorporation (approx.) |

Appox. 5 week |

| Management (local/foreign) |

Local or foreign |

| Legal representative required |

No |

| Local bank account |

Yes |

| Independence from the parent company | Independent legal form |

| Liability of the parent company | The parent company bears no liability for its subsidiary/subsidiaries |

| Corporate tax rate | 24% |

| Possibility of hiring local staff | Yes |

Table of Contents

Steps for opening a subsidiary in Austria

The following steps need to be completed for the creation of an Austrian subsidiary company:

- select a company name and reserve it with the Companies House;

- draft the incorporation papers with a local notary office;

- set up a corporate account with a local bank;

- file the documents with the Trade Register and obtain a tax identification number;

- apply for the necessary licenses to start operating.

Voluntarily, the company can also be registered for VAT purposes to simplify the operations once the mandatory registration threshold is reached.

Our company registration agents in Austria can help you set up this business form with the help of a power of attorney.

The minimum share capital for opening a subsidiary in Austria

Foreign companies opening subsidiaries in Austria must open corporate bank accounts and deposit a minimum share capital of 35,000 euros for private limited companies.

Before the process of company registration in Austria can proceed, 50% of the share capital must be deposited in the bank account.

Each shareholder in a private limited company must invest a minimum of 7,000 euros. There are no specified requirements regarding the residency or nationality of shareholders for private limited companies.

If you want to open a subsidiary in Austria as a joint-stock company, a minimum capital of 70,000 euros is necessary. Joint-stock companies must have a supervisory board comprising at least three members as a mandatory requirement.

In 2024, foreign investors who want to open Austrian subsidiaries can choose the type of legal vehicle they want, however, they need to apply for various business licenses and permits.

Requirements for opening an Austrian subsidiary in 2024

The representatives of foreign companies can open subsidiaries in Austria under the form of limited liability companies which can be public or private. However, the most employed form is the private limited liability company.

Compared to the branch office, the subsidiary is an independent entity which requires the following documents for registration:

- a copy of the parent company’s certificate of registration issued by the Trade Register in its home country;

- the parent company’s resolution indicating the opening of the subsidiary in Austria;

- information about the representative of the company in Austria;

- the incorporation documents of the subsidiary which must be drafted in German.

All documents must be translated into German and certified by a local public notary.

After you open a subsidiary in Austria, you must make sure it follows some additional requirements, such as:

- In case of hiring employees, they must be properly registered for social security benefits;

- There might also be a requirement to display a company seal, which signifies your subsidiary’s official status;

- Compliance with Austrian tax laws, including corporate income tax and value-added tax (VAT), is a must;

- Informing local authorities about your subsidiary’s presence by filing the company title with the municipality is another administrative task;

- Lastly, giving share certificates to shareholders is a standard practice to establish transparency and compliance with the ownership structure of the subsidiary.

Our local agents can help with the preparation of the incorporation documents when setting up a subsidiary in Austria in 2024.

Taxation of Austrian subsidiaries

Tax considerations and incentives are important for foreign businesses looking to establish subsidiaries in Austria. It’s advisable for companies to carefully assess their tax obligations and seek guidance from tax professionals such as our accountants in Austria.

The main taxes an Austrian subsidiary might encounter are the following:

- corporate income tax (24%);

- VAT (20% standard, 13% or 10% reduced, 0% for specific services);

- withholding tax (23% for dividend payments made to another Austrian company; this is reduced in some cases).

In addition to these taxes, there are also potential tax incentives available after you open a subsidiary in Austria, including:

- group corporate taxation,

- research allowance,

- double tax treaties.

Our team can provide more details about taxes and incentives that may apply when you set up a company in Austria.

Hiring employees through a subsidiary in Austria

Running a business in Austria implies respecting the Employment Law here. However, the parent company can apply for work permits on behalf of the employees it wants to transfer in Austria. This requirement applies only to non-EU citizens, as the rules are more flexible for EU ones.

If your subsidiary in Austria plans to hire non-European Union (EU) nationals in Austria, you must follow the rules and regulations governing the employment of foreign workers. Importantly, you can only hire employees in Austria after obtaining the necessary work permit.

We also inform you that in Austria, written employment contracts are not mandatory during the recruitment process, after you start a business in Austria. Verbal agreements between employers and employees are common and legally acceptable. Collective agreements in Austria hold significant importance as they define minimum working conditions, employee rights, and benefits. Employers cannot unilaterally change the terms and conditions of such agreements unless agreed upon beforehand.

Hiring employees in Austria also implies registering them for social security purposes here, a situation with which our local consultants can help you.

You can receive more details about employment procedure after opening a subsidiary in Austria, by discussing with our team.

Management requirements for company formation in Austria

Setting up a subsidiary in Austria implies respecting local regulations that stipulate the requirement of having at least one director. The advantage lies in the fact that the person appointed can have any nationality and must not be an Austrian resident. In practice, foreign companies appoint directors from the headquarters who move to Austria and manage subsidiaries from here.

The same management requirements apply to private and public companies, no matter the selected legal entity. You can obtain more information on this requirement from our local advisors.

Why set up a subsidiary in Austria?

The subsidiary company is an independent company that can complete a wide range of activities that are not limited to those of the parent company. Also, from a taxation point of view, the subsidiary is considered a tax resident company, therefore will benefit from the same tax treatment as local companies.

This means that the subsidiary will be subject to the corporate income tax, the value added tax (with its standard rate and its reduced rates), social security contributions, payroll tax (at a municipality level), real property tax, transfer tax or stamp duty.

It is also possible to open a subsidiary by purchasing a shelf company in Austria. The advantage of choosing this option is skipping the incorporation procedure that can span over 5 weeks. No matte your option, you can count on our officers for support.

Licensing is also one of the phases to go through when opening a subsidiary. All foreign companies are required to register with the industry representing body, as well as with the municipal authorities before starting operating.

If you want to set up a subsidiary in Austria, our team can give you complete information about the current tax incentive programs (if applicable in your case), as well as other advantages for subsidiary creation.

Why invest in Austria in 2024?

A strong economy, a central European location, and a favorable business climate are the main reasons for opening a company in Austria. Additionally, these statistics about Austria’s financial and economic stability underline the country’s strong foundation for investment:

- According to datasets made available by the statistical office, there were 35,371 new companies incorporated in 2021, an increase of 0.3% compared to 2020;

- In 2021, the total number of companies in the country amounted to 589,615 and these companies employed a total of 3,590,035 individuals;

- The business turnover for 2021 was 894 billion euros;

- According to a recent macroeconomic forecast for Austria published by the European Commission, the country’s economy will recover gradually, with growth increasing more significantly in 2025; Private consumption is expected to drive this growth.

If you decide to set up a subsidiary in Austria in 2024, you can ask our agents about the latest conditions to respect.

If you want to open a subsidiary of your foreign company and need help, please contact our Austrian company formation advisors.